How I saved $75k to move abroad (in a pandemic)

First off, yes. I really did save $75k this past year. That’s a little over $6k/month…all while IN A PANDEMIC.

Secondly, I know that I am speaking from that of privilege because I was able to keep my job & work remote. I am also going to be straight up with you that a good chunk of the money came from selling my house and car. Let’s go ahead and run those numbers out now.

So I sold my house in October 2020 for $50K more than I paid for it. Obviously you put in some money with a down payment, closing costs, repairs, etc., but I still made quite a profit. Then used car sales have been exploding this summer/fall, so I actually made an extra thousand more than I expected. Some of it was timing, some of it was doing the leg work way ahead of time, and some of it was the pandemic allowing me to say no to a lot of things I would normally be paying for. But even with all that, I still needed about $25K to make this happen so it took some sacrifice.

I hope this can give you some inspiration or ideas because even the small stuff adds up. If you are determined to save and can make sacrifices in the short term it can be done.

Know your WHY

Having a deep rooted cause for your savings whether that be an emergency fund, travel, house, etc. will help you continue to push forward when the motivation weans in and out. My why was obvious- moving abroad. Financial stress is the last thing I wanted during this amazing adventure, and I knew exactly how much I needed in order to make this happen and keep an emergency fund. Everyday it fueled my choices financially.

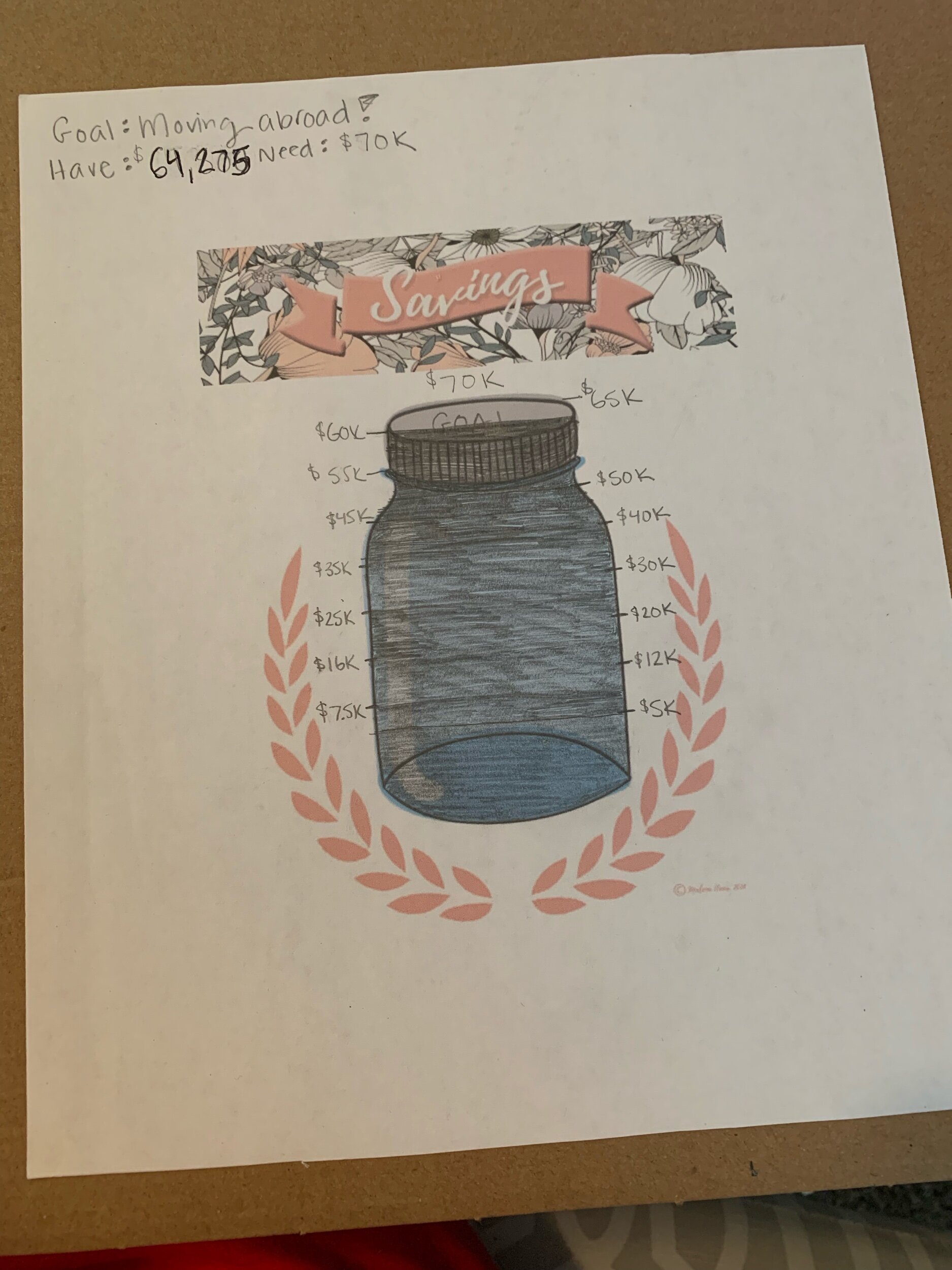

Have a visual savings chart

I had a picture of a jar that had lines for every $5K saved, but you could make it any increments you want. Each time I was able to shade it another 5K gave me such a dopamine rush knowing I was inching closer to my goal.

Make it a part of your budget

Figure out what your end goal amount is then divide it into smaller chunks to make it seem more feasible. After I sold my house, I was just 6 months out & had $25k still left to save, so I knew I needed to save ~$2,500 a month. That’s what led me into the next point…

Sell off whatever you can

We can live off less than you think. During the first lock down, I was able to live off a suitcase for six weeks while being back at my parents house. Sell clothes, electronics, or in my case, you might even decide to sell your house. 😬 When I sold off the rest of my belongings the weeks leading up to moving abroad, I made an extra $2000 off FB marketplace. If I didn’t use it daily, and wouldn’t use it abroad, it got sold.

INVEST

This one might sound counter intuitive, but seriously start investing outside your 401k. Put your emergency fund into a high yield account, open a brokerage account, etc. These are areas where your money can grow on it’s own while you continue to work on your savings goal, and when you need the money there is no tax or penalty to take it out. So let’s say I knew my goal was going to take a year, if I only invested $1,000 in the S&P 500 since last 2020.. I’d have made an extra $330 in just one year with no effort other than patience. And the more you invest = more potential earnings.

Make some extra $$$

Even if you are the CEO of a huge corporation, you are never too good for doing extra work when needed. Plenty of people are doing side hustles, heck our generation seems to have multiple at one time these days! Some things I did was babysit, dog sit, do online surveys, affiliate marketing. You could also do things like donate plasma, start a yard work company, create something to sell on etsy, be a freelance writer…use your talents!

Improve your circle

Have people who know the journey you are on, and understand how important it is to you. This past year I was not great at giving gifts, or going out all the time for brunches, and my friends knew that. We did free things instead, or they let me crash with them when I had sold off all my stuff, including my bed. Your circle also includes what you allow to penetrate into it- this goes for podcasts, media, etc. I listened to a money podcast on a walk everyday during the first 6 months of my savings journey which really shaped my plan of action and kept my eyes on the prize.

So there you have it, $75k saved in just a year due to house sales, side jobs, selling off everything I own, you name it. It’s honestly been such a game changer for me knowing I did it, coming from a girl who used to spend her whole paycheck on “stuff.”

Now time to go find a side hustle here in London so I can stay longer. 😉

Sincerely,

Sarah

Follow me on instagram @sincerelysarah.co for travel tips, stories, and reels!P.S. Don’t forget to subscribe to get more updates on future travels and tips!

My little savings chart. I bumped it up to $75k after I surpassed my first goal.